They bought 3 Rentals in 12 months. All while living overseas…

Started with their own home. Our strategy + Power Teams = 3 rentals in 12 months.

Instead of losing -$18,000 per year, they are earning income from day 1.

Who?

Crissy and her partner moved to Melbourne, Australia. But they still wanted to invest in the New Zealand property market which had better cashflow returns. Plus they knew they’d end up back in NZ at some point so wanted their assets there.

Property details

They joined the Accelerate program and initially bought a rental in Whangarei for $375,000.

Then as their second move they bought rentals #2 & #3 - a duplex in Wellington region.

💰 Purchase price: $755,000

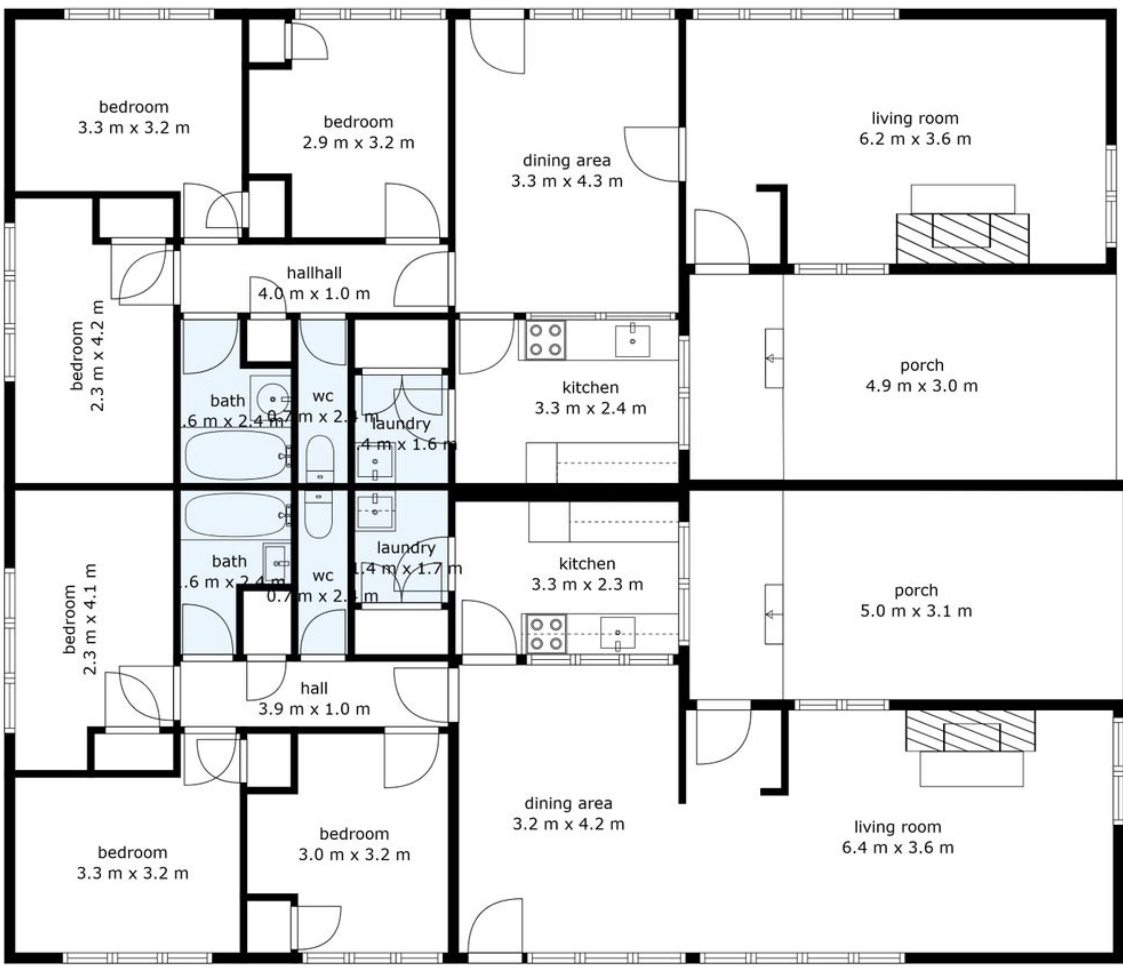

🛏️ Original Configuration: 2 x 3-bedrooms

How did we Cashflow Hack this?

The secret sauce here was adding a fourth bedroom to each of the units.

Original Floorplan

Cashflow Hacked Floorplan

Cosmetic Renovation Scope (per unit)

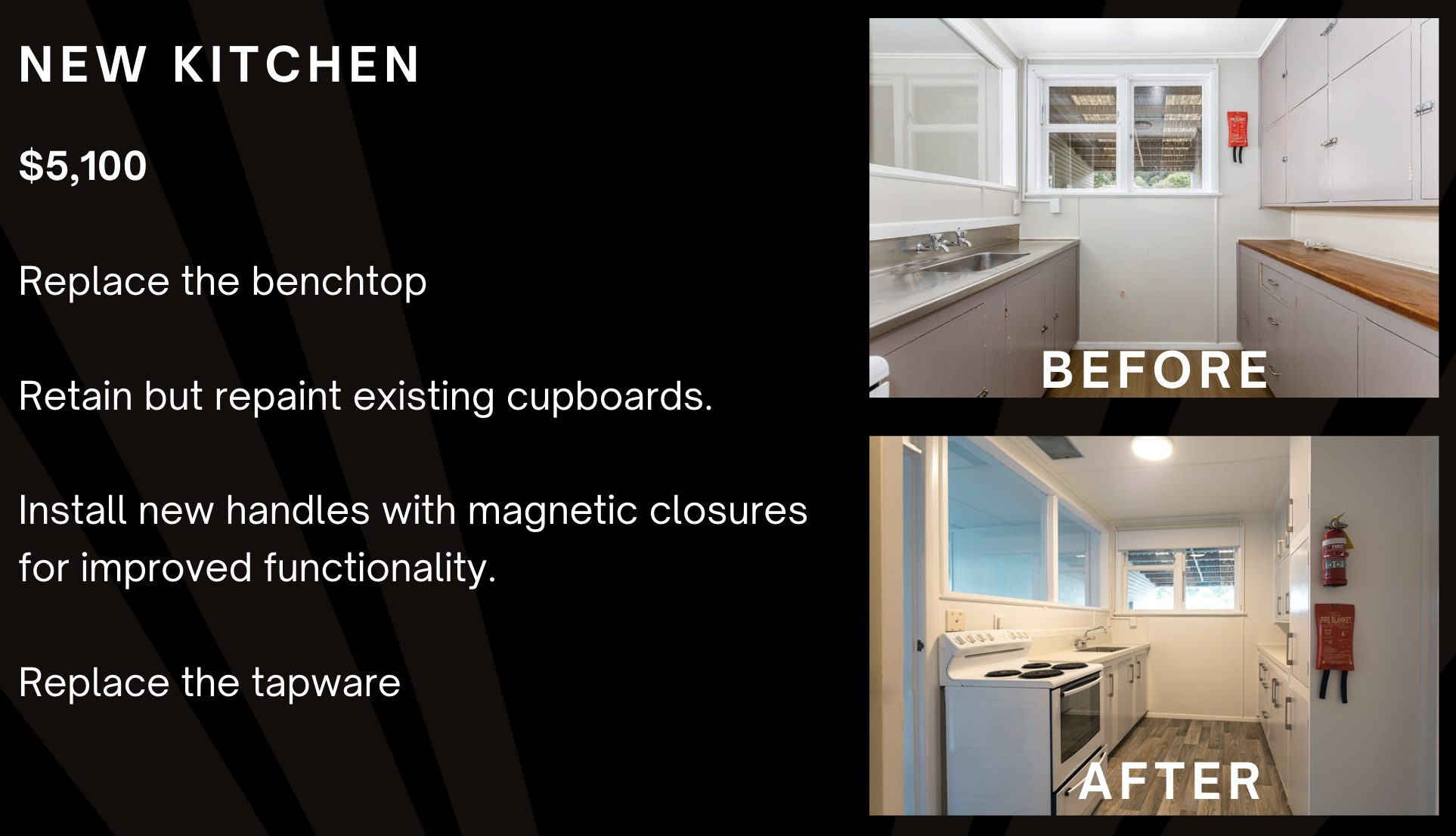

New Kitchen

$5,100

Replaced flooring with carpet and vinyl

$9,500

New Plaster and Paint

$7,500

Cost to add new bedroom

$5,500

The results

Not only were the results impressive, but the speed - this entire renovation across both units only took 3 weeks!

Purchase Price = $755,000

Renovation = $80,000

Total Investment = $835,000

Gross Yield (rent over / total investment) = 8.1%

Positive Cashflow

If this client were to buy the property and do nothing, they would need to top up the rental by $18,000 every year!

However the renovation and extra bedroom created a significant rental increase, so that it was now bringing in passive income every month.

Future Potentials

Subdivide - They could choose to subdivide and legally split these two dwellings. This would increase the value of each unit.

Cabins - option to add cabins when there is rental demand. This would give a boost to the rental income.

Watch Webinar for the detailed breakdown

Click here to watch the webinar

Or if you want to get ahead and start building your property portfolio - book your free 15 minute discovery call now.